Boring is back – Why Bonds are more tax efficient than any time in my lifetime

For the past several decades, decreasing interest rates have led to a bull market in Bonds, leading to increased prices and decreasing yields. This has meant that bonds have generally outperformed GICs, as seen below.

The reversal has occurred in recent years, where increasing interest rates led to declines in bond prices, meaning that GICs have outperformed for the first time in recent history in the fixed income category.

Figure 1: Bond vs. GIC returns from 2008 to 2022

However, though this may lead you to believe that GICs are the optimal fixed income asset, this is not the case.

For the first time in my lifetime, bonds are deeply discounted to par. If you believe in the buy-low, sell-high mantra often used in the stock market, the same is true today in the bond market. Even though bond markets have fixed returns over the long term, there are 3 major advantages they have over other fixed income such as GICs.

1 – Bonds have an opportunity for short-term appreciation

If interest rates go down, as is expected by economists, bonds have the opportunity for short-term capital gains. This is technically not a major benefit because the gains cannot be realized without reinvesting in an alternative asset (at a lower rate) so over the long term this short-term capital gain is not real. However, in the short-term having a capital gain can be beneficial if re-invested in an asset that is not interest rate sensitive.

2 – Bonds are liquid

A major advantage is that bonds can be sold at any time. This will allow investors to adapt quickly to change asset allocation if the timing is important. Cashable GICs can of course be bought, however they will have a reduced rate that makes them less competitive with bonds.

3 – Taxation – Now is the golden opportunity for Bonds

Bonds are taxed in 2 ways:

1: Interest (coupon payments) are taxed as normal income, which is no advantage

2: Capital gains are taxed at 50% (the inclusion rate), which is great! Paying half the tax, what more can you want?

So, the question is how can you have as much of your gains as possible be capital gains?

The answer is that right now there are many bonds that are significantly below par value (depressed prices). This means that you will get the majority of the gains as capital gains, with only half the tax!

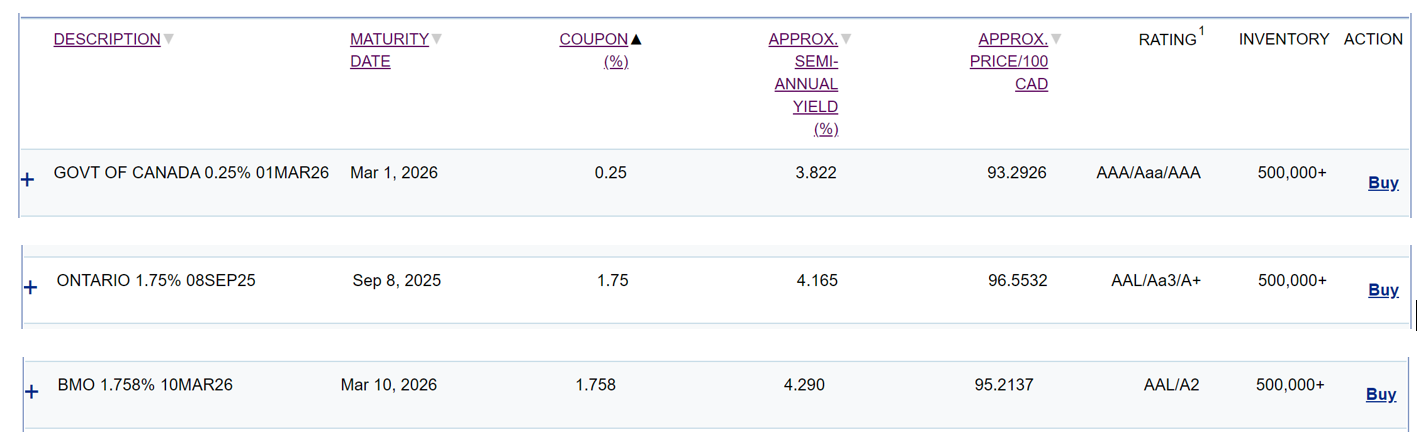

For example, below is a government of Canada bond paying a coupon of 0.25%, but the yield to maturity is 3.8%. This means that 93% of all gains will be taxed as capital gains!

That is an incredible advantage that GICs do not offer.

Figure 2: A 2 year government of Canada, Ontario, and Corporate bond on March 11th 2024

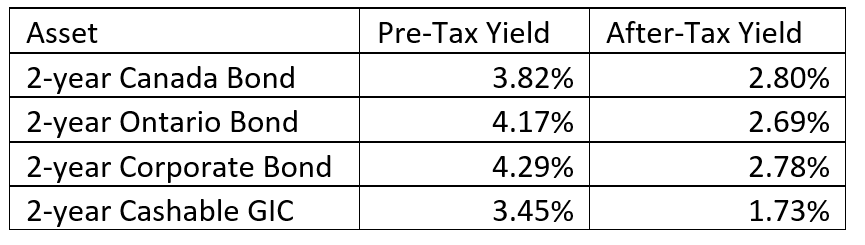

Let’s compare to a 2-year cashable GIC (choosing cashable to emulate the liquidity of bonds), which has a yield of 3.45%. Assuming a marginal tax rate of 50%, the difference is massive! Even though the yields are similar pre-tax, the bonds outperforms the GIC by a almost 1%!

Table 1: Bond yields (before and after tax) compared to a 2-year cashable GIC

Now, for the downsides to Bonds:

1 – Bonds have default risk

When you buy a bond, you are loaning money to a government or company. If this government or company declares bankruptcy, you may not be paid back. This risk is real, but very low if you buy bonds from governments or companies with a very high credit rating. For example, a government of Canada bond would only have default risk if the government of Canada were to default on its loans. Though this is possible, and the risk increases with uncontrolled government deficits and debt, it is incredibly unlikely.

2 – Higher trading fees

A major downside to bonds are the higher trading fees and commissions. Even with discount brokers, some have minimum transaction fees of $20-25. On a bond purchase of $10,000, this is a 0.2% fee. Not a deal breaker, but not insignificant. This is especially important when buying short term bonds (the fee will make up a bigger part of the overall return) and when investing small amounts. Buying bonds is therefore not likely worthwhile when investing smaller amounts.

3 – Interest rate risk

On the flip-side to capital gains when interest rates go down, bonds will lose value in the short-term when rates go up. Most economists believe that rates have peaked in the near term and the risk of increasing rates is low right now. Conversely, these gains are non-existent long-term as re-investment in higher yields long term will derive the same value as the short-term losses.

4 – Registered and Tax-Free Accounts

In registered or tax-free savings accounts, there is no difference in capital gains vs. income, so the taxation points above do not apply.

None of the above points mean that bonds or GICs are necessarily the right investment for you and your specific personal circumstances. You should never make financial decisions without thorough investigation and a comprehensive, personalized financial plan.

If you want to learn more, and how fixed income can be optimized in your personal situation, reach out and we can discuss further.

Chris Fliesser, PFA, P.Eng.

Financial Advisor

Fliesser Financial