Why you SHOULDN’T use your TFSA to pay off your mortgage

Ron Carrick recently wrote a piece in the globe and mail advising on the merits of withdrawing your TFSA to pay off your mortgage.

I couldn’t agree less.

Firstly, you are likely to get much better returns in your TFSA than your mortgage rate. FP Canada estimates equity returns at 6.2%, far better than current 5% mortgage rates.

But even in the most conservative scenario, investing in GICs, leaving your money in your TFSA is better.

What we are missing here is a key piece of this analysis: TFSA Room.

TFSA contribution/recontribution room is a limited, precious resource. It allows more dollars to grow tax-free.

And if you take out your TFSA funds, they stop growing, that means your potential TFSA room stops growing too.

This is why I often recommend to my clients the opposite: You should never empty your TFSA to pay off a mortgage if you can get comparable investment returns to your mortgage rate.

How does this work? Let’s imagine 2 scenarios, one where a client pays off a $100k mortgage with their 100k TFSA and another where they do not.

Assumptions:

You are 10 years away from paying off your mortgage with a $100k balance

You have a TFSA with a balance of $100k

5% investment return (very plausible https://www.theglobeandmail.com/investing/markets/inside-the-market/article-the-5-gic-makes-a-surprise-comeback/)

5% mortgage rate (obtainable right now)

Assuming a 10-year amortization gives a payment of $1058 per month

This is a black box (no other funds available)

TFSA contribution room given on Jan 1st each year, $7k this year indexed to inflation and rounded to nearest $500.

Note that all withdrawals from your TFSA give you the same amount of re-contribution room.

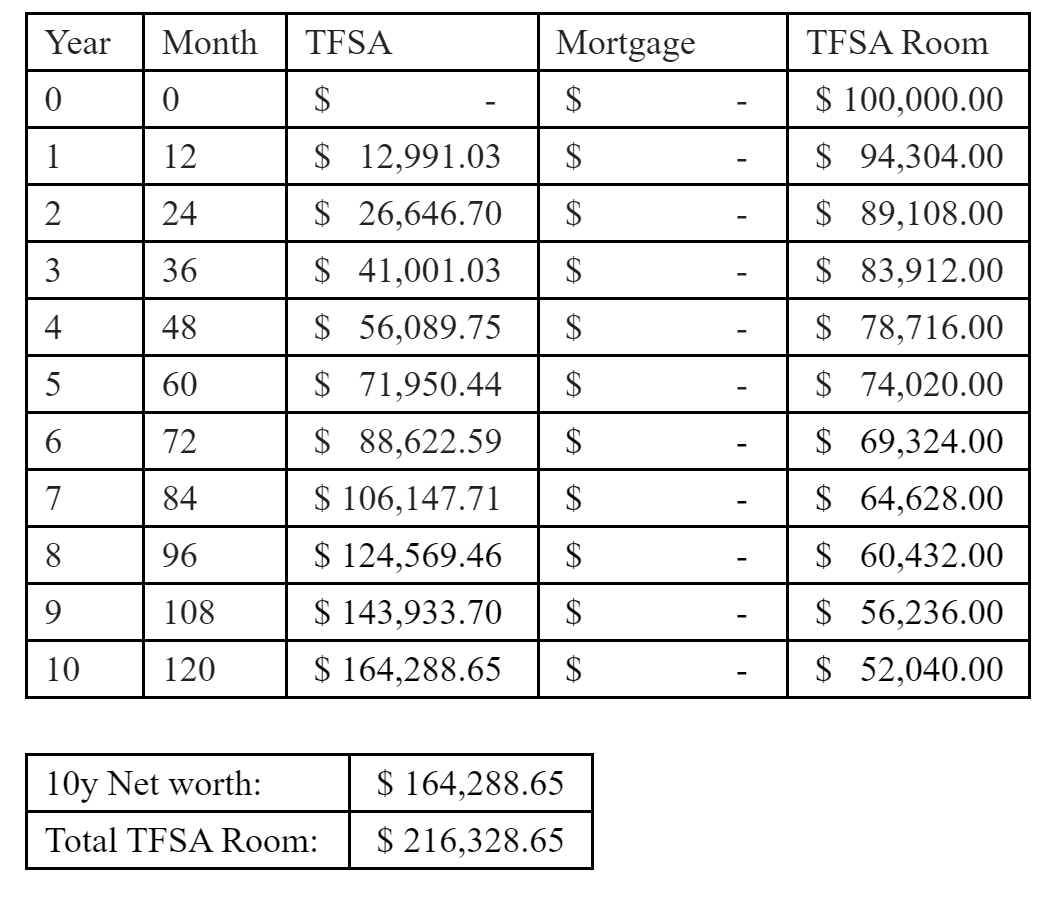

Scenario 1: Pay off Mortgage and contribute to TFSA with mortgage payment.

As you can see below, you have no assets or debts in year 0, and we will give you the benefit of the doubt that you did this rebalancing on December 31st to get the room back right away (the scenario is even worse without this good timing).

You start redirecting your previous mortgages payments of $1058 each month into your TFSA.

By the end of 10 years, you have a TFSA value of $164,288.65, and total possible TFSA contribution/recontribution room (room remaining + TFSA value) of $216,328.65.

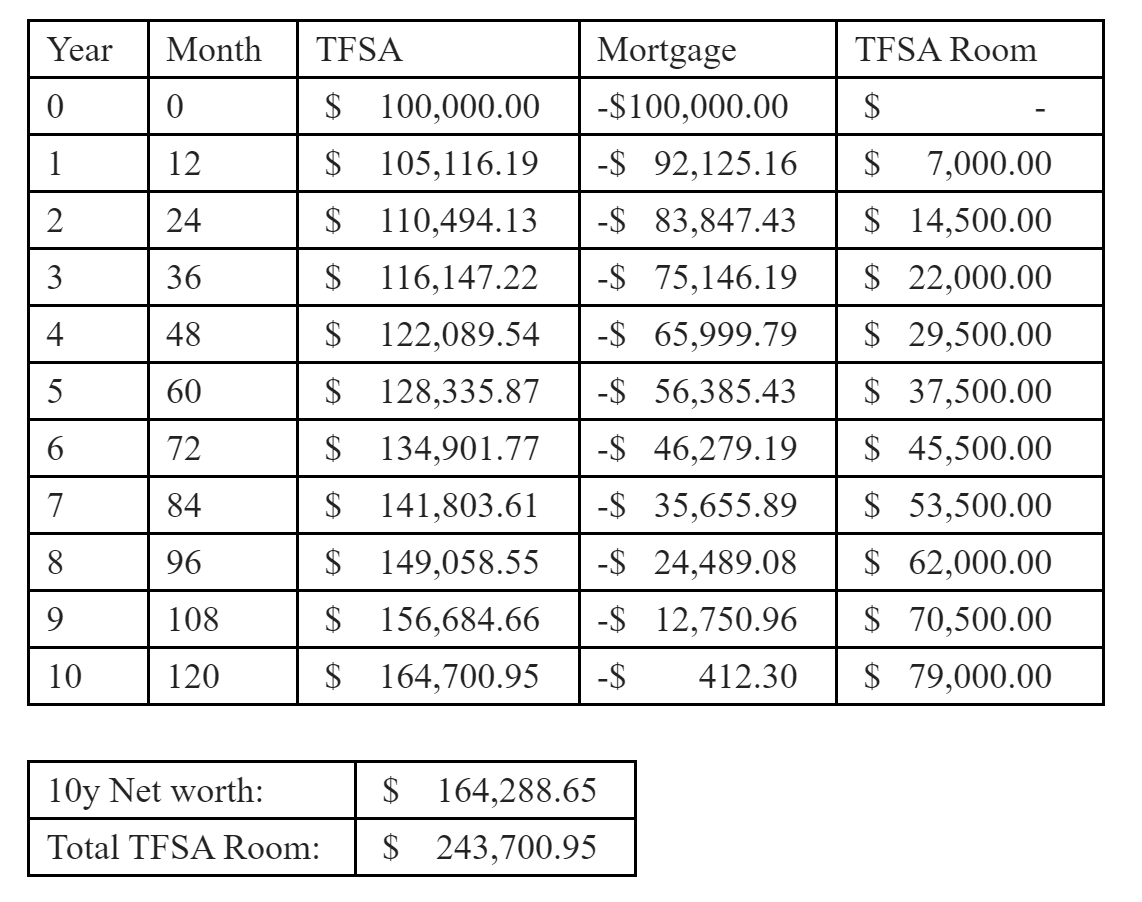

Scenario 2: Continue to pay off mortgage and let your TFSA grow.

As you can see below, you keep your TFSA and use the $1058 to pay off your mortgage each month. After 10 years you are mortgage free (after a small lump sum).

You do not have cash left over to contribute to your TFSA.

However, your TFSA continues to grow compounded at 5%.

By the end of 10 years, you have a net worth (TFSA - lump sum mortgage payment) of $164,288.65.

This is the exact same net worth as in scenario 1, which makes sense because both rates are the same at 5%.

However, your total possible TFSA contribution/recontribution room has grown in a compounding manner to $243,700.95.

This is $27,372.30 more than in scenario 1!

Ask yourself this: If you could get $27k in TFSA contribution/recontribution room for free right now would you take it?

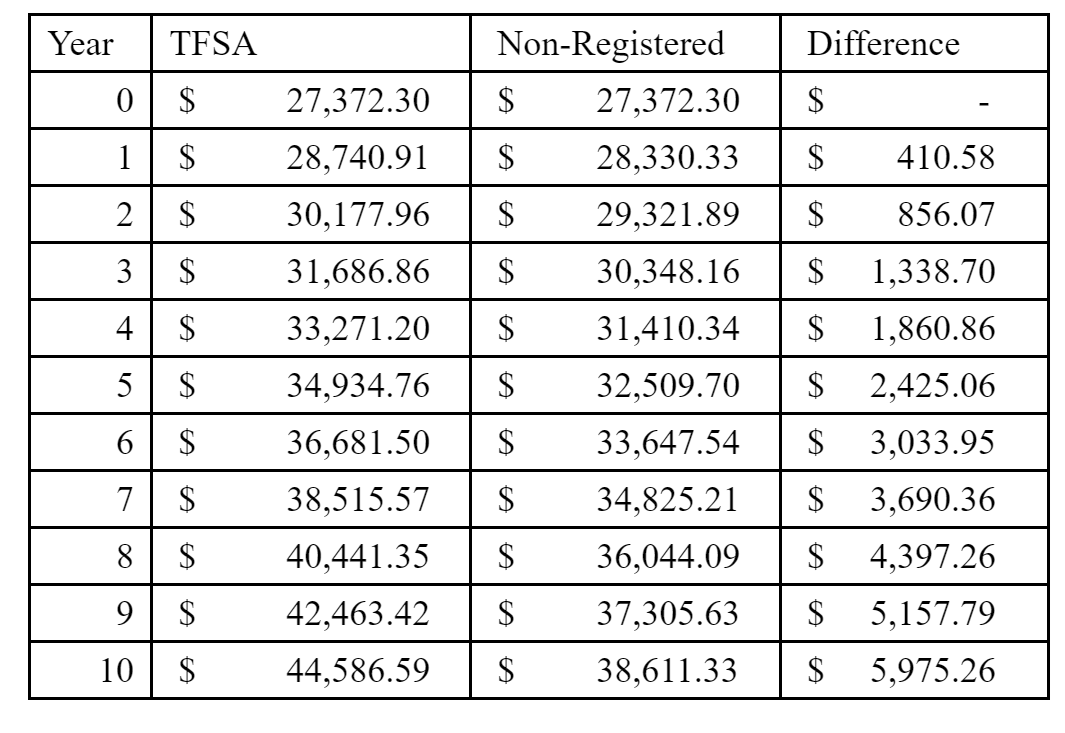

Now what is the value of TFSA room? How good is this?

Assuming you reach a scenario in the future where you max out your TFSA and you continue to invest at 5%. Assume a tax bracket of 30%. An extra $27,372.30 of contribution room over the next 10 years would gain you an extra $5,975.26!

Now I would never say no to a free $6k!

This is why I recommend to my clients to keep their TFSA, unless they believe that their investments will return less than their mortgage rate. And of course, this doesn’t mean emptying your non-registered investments is not a good option.

And this is assuming you are only obtaining a 5% investment return, which is likely a conservative estimate.

Rob does mention the psychological and emotional aspect of paying off your mortgage. This is definitely a consideration which may be right for you if it is less stressful to remove your mortgage payments. However the beautiful thing about mortgage payments is its a forced savings plan. If you are going to pay off your mortgage early, make sure your payments are being redirected in full to your TFSA.